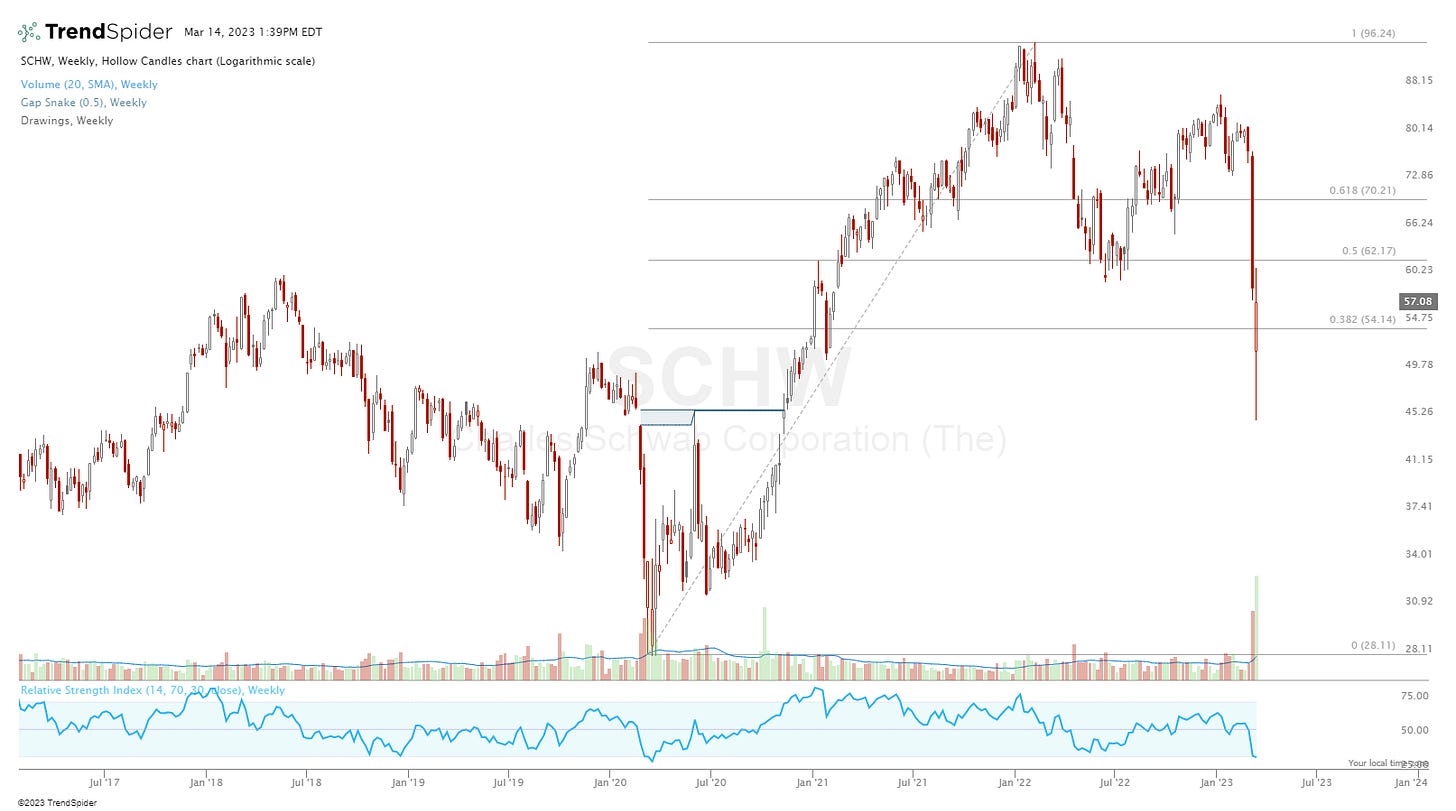

I don’t know if SCHW 0.00%↑ is done falling, and the chart setup is high risk/reward at this juncture. That drives up vol, and in turn, options prices. Current spread on a 35/30 Jan 2024 put spread for SCHW 0.00%↑ is about $0.75 or about 15% of the at-risk amount, over~ 9 months. A pretty solid ROI on a bet that SCHW 0.00%↑ won’t drop another ~40%, and the chart shows that such a drop would put the price near its covid low. Oh, and the CEO purchased 50,000 shares this morning.

Discussion about this post

No posts