URBN 0.00%↑ is up big on a post earnings gap and go that has brought the share price right up to a prior all-time high from 2018. Coincidence, I think not.

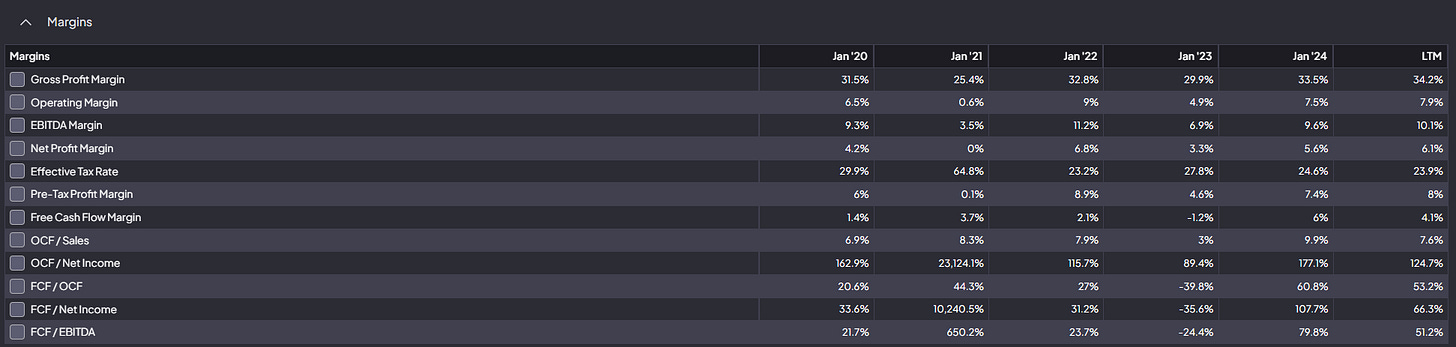

I don’t believe there’s any edge whatsoever in dissecting the fundamental metrics, since they’re readily available to everyone, but for what it’s worth, margins and trailing valuation ratios are all at the upper end of where they’ve been over the past 5 years (unsurprising).

More importantly, momentum from this recent thrust up appears to be fading.

Hence, the “tactical short” view. This looks like a short time frame opportunity to pick up some regression points. It’s a low risk trade using the $52.50 all-time high as a level of defeat. I’m increasingly looking for some of these types of setups to offset long exposure, something perhaps might not materialize into after the New Year.