SOFI 0.00%↑ reported on 1/30, and the stock has run up ~17% since. The orange line depicted below represents the AVWAP (“anchored volume weighted average price”) from the company’s IPO date. It tells us the average price an owner who purchased each day since the IPO is in for. While this might be a more preferred entry point for a true long, we can still participate in this name right now in my opinion.

Here’s how I’m doing it.

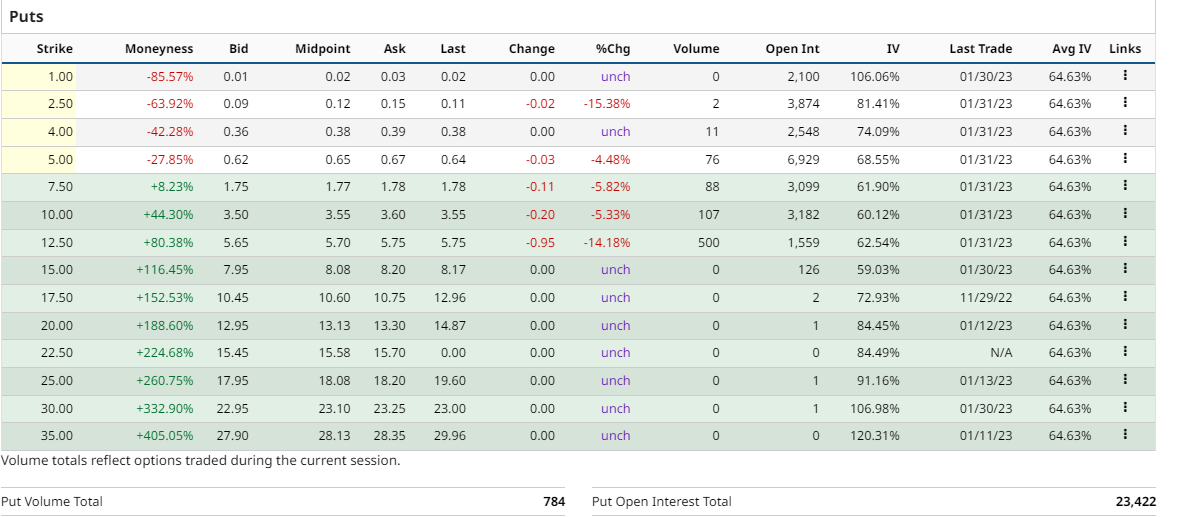

Here’s a table of the 12/15/23 expiring put options for SOFI 0.00%↑ . The price action post earnings tells me that the $4-$5 range might prove to be the bottom, at least in the short-term (measured in my selection of the December current year options). I’m selling $5 puts, which net ~$65 per contract. The margin reserve is ~$140, and the downside risk is $500, if the company were to go out of business before December of this year. So you’re capturing ~9% of the current stock price, with a de minimus reserve. The likelihood of a complete loss of the $500 is minimal, though you’re collecting 13% up front on that. For a max 10 month hold. Now there’s no requirement to hold the full term, and given the high implied volatility of the option, it’s very likely there will be no need to hold for the duration, enhancing the return characteristics if the bet proves correct.

My expectation is is to hold this for a run up to that AVWAP, at which point it’s very likely I would’ve captured my target 50% return on the option sale, and can then decide what to do next. Conversely, a reverse course doesn’t begin to concern me until the stock takes out its December ‘22 low of $4.24.