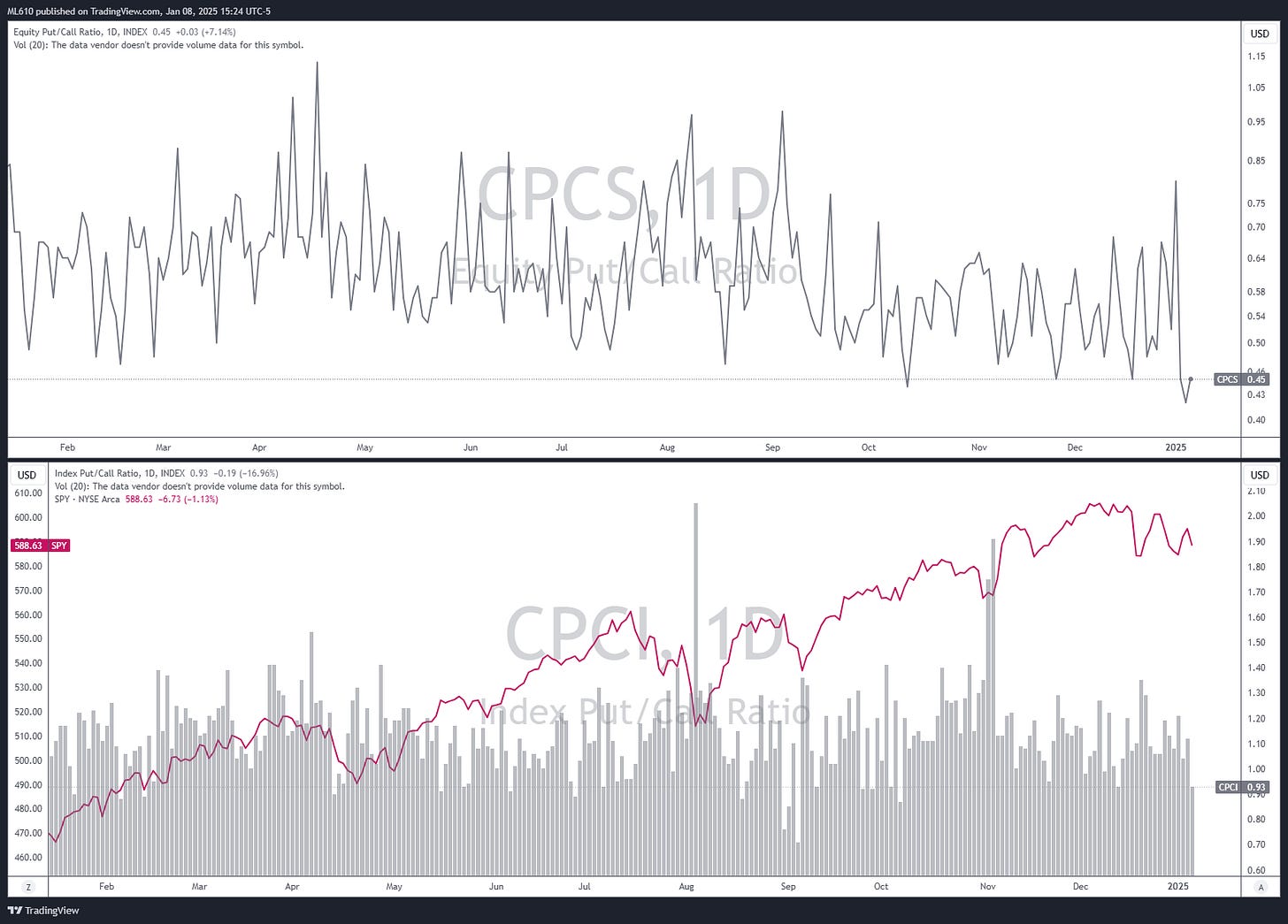

Index put/call ratio sub 1.00 and declining over a rolling 5 day period. Equity put/call near one year low. These metrics point to what’s been a measured sell-off to start the year.

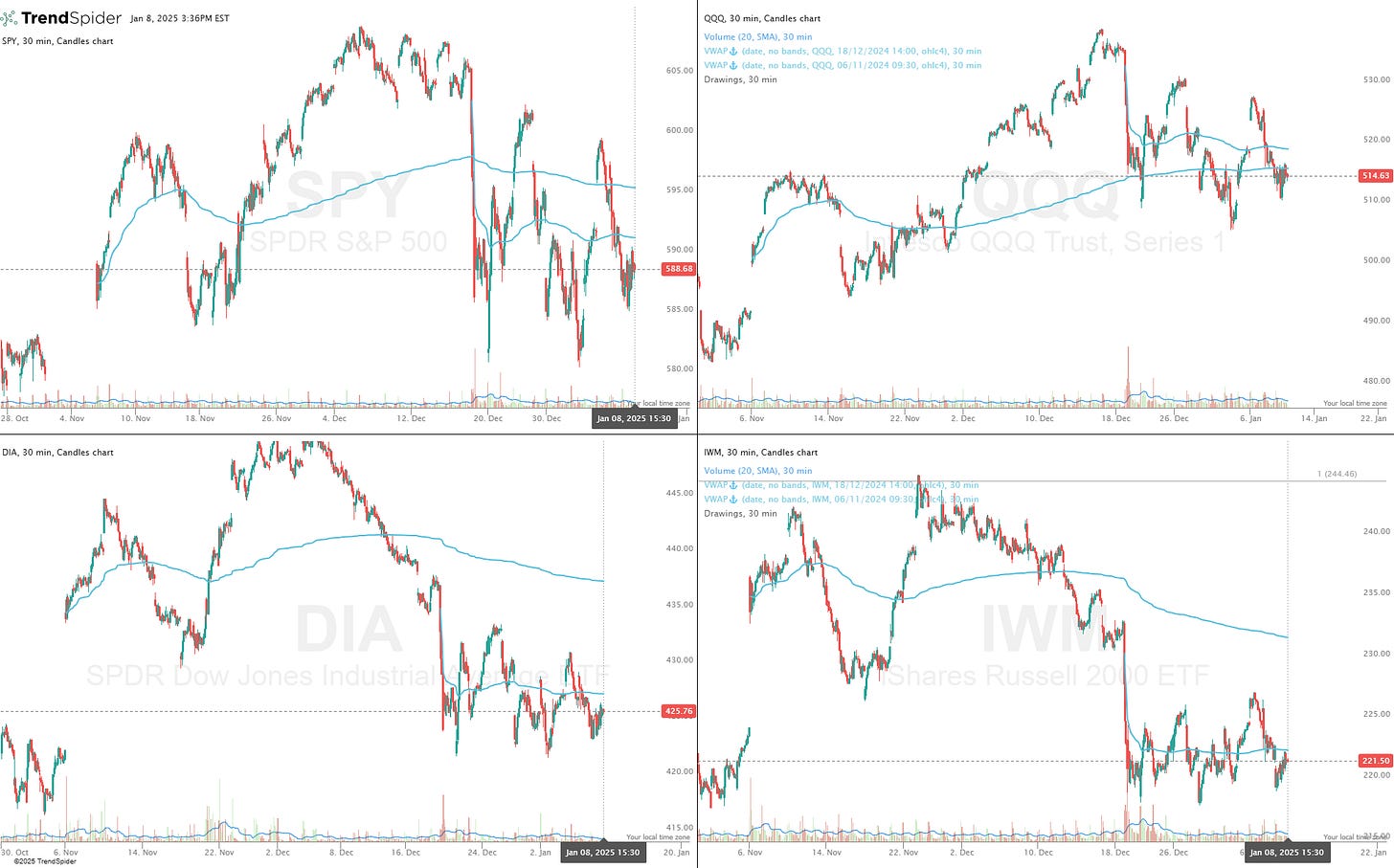

Indices remain below AVWAP from election (gap up) and Powell’s last presser (sell-off). This remains a cautiously risk-off tape given these factors.

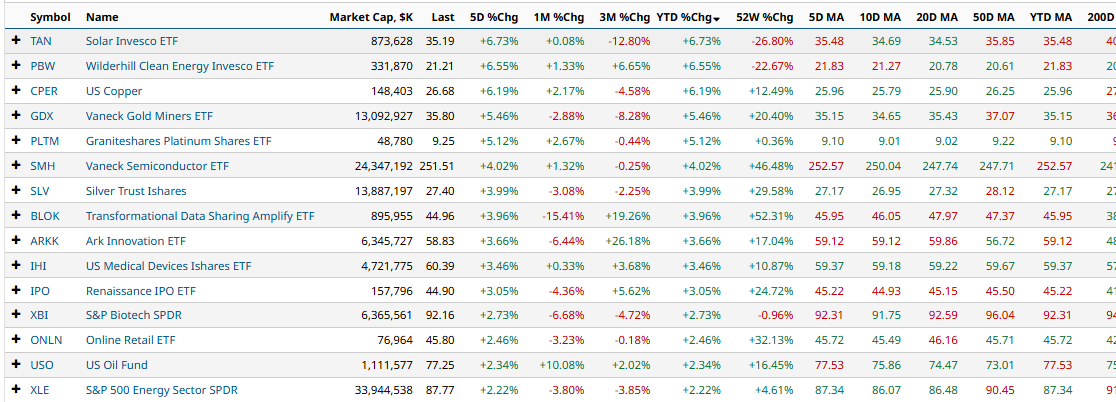

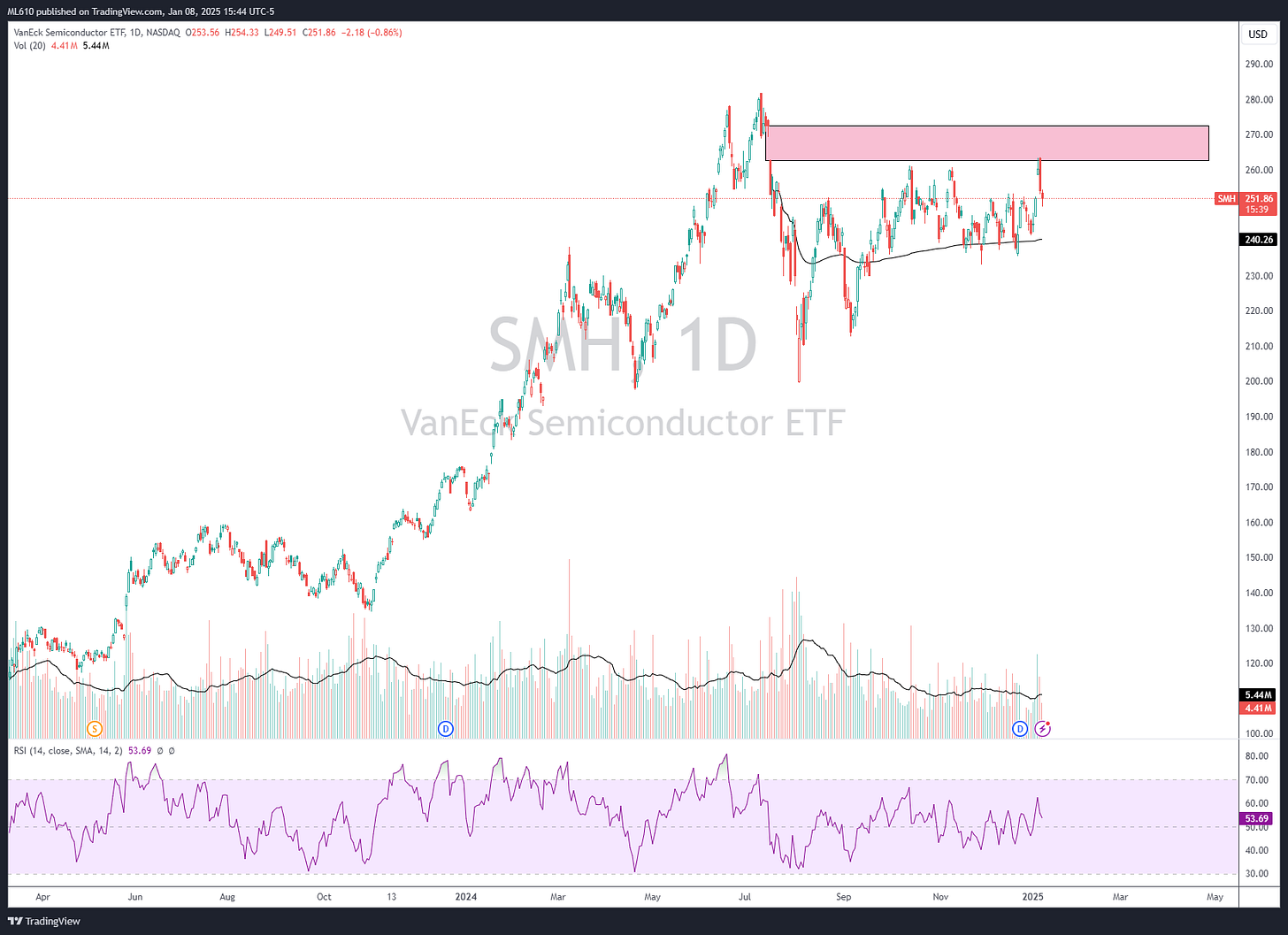

The ETF themes leading thus far were mostly sold off in Q4, SMH 0.00%↑ interests me most after getting rejected this week at an overhead gap. It remains above a flat 20 day moving average, which hopefully means nothing worse than sideways consolidation before a leg up.