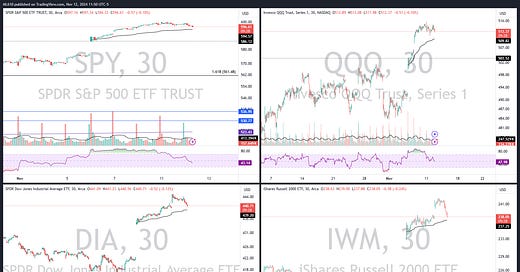

30 minute charts with AVWAP’s drawn from last Wednesday’s open. One week post election pop, we’re seeing pullbacks in all major indices towards the Wednesday morning VWAP. This is constructive, if it holds. It’s not catastrophic if it doesn’t as some backfill of the gaps is perfectly reasonable as well. But below those AVWAP’s does not signal a time to be chasing this recent move up. A bounce off of them is much more constructive for doing so, as is a break and subsequent reclamation of those levels. I think the post election gap range and AVWAP provide good risk management levels for managing new positions going into year end. This pertains to index and individual stock charts.

Discussion about this post

No posts