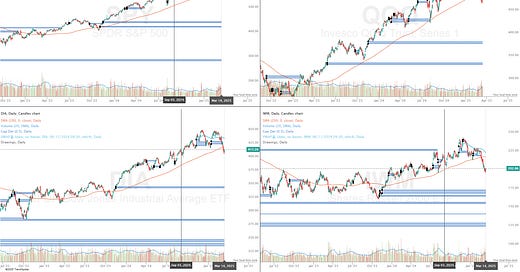

All four major US indexes remain below what are flattening 200 day moving averages. What’s scary are those unfilled gaps below (represented in blue above). They represent levels of interest should the market continue to pull back further, and until these indexes reclaim those 200 day moving averages, the expectation should be that they will pull back further. And that’s fine. It’s why risk management levels must be respected.

Discussion about this post

No posts