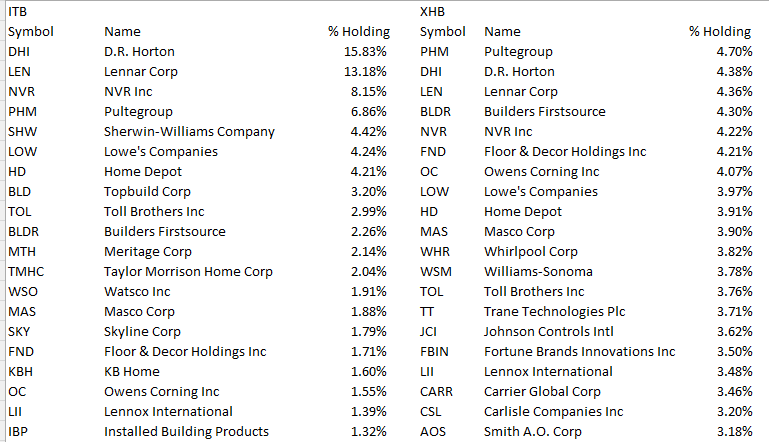

Homebuilding stocks were at the top of the leaderboard this week, and given the macroeconomic backdrop, that seems important. The two key ETF’s that I watch in the space are XHB 0.00%↑ and ITB 0.00%↑ .

You can see the XHB 0.00%↑ is more balanced, with over 40% of the fund in the countries largest home builders.

A zoom out of the ITB 0.00%↑ relative to SPY 0.00%↑ shows it in a range that’s represented a topping out area since the GFC.

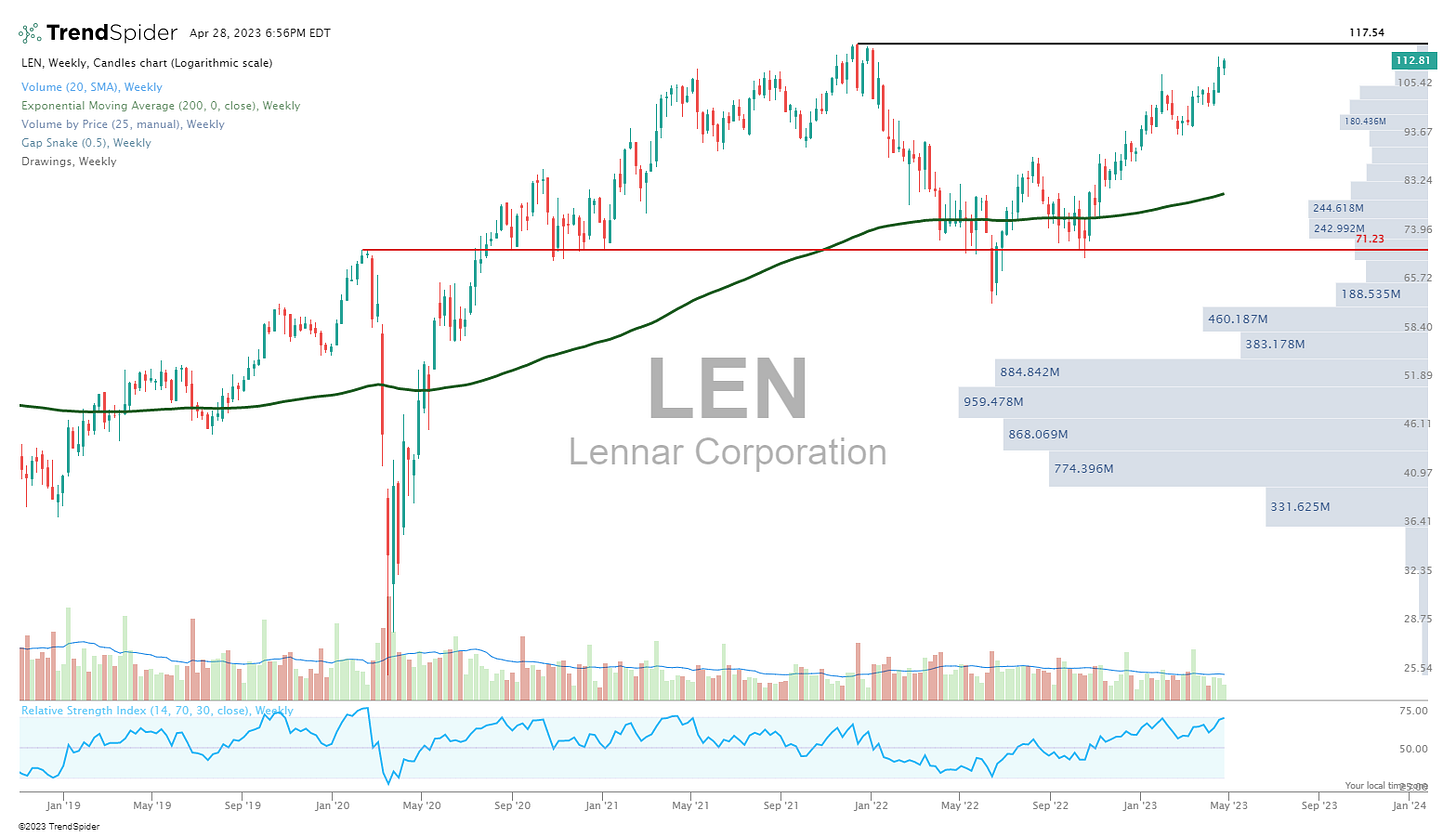

DHI 0.00%↑ is sitting on the level it topped out at in December ‘21.

LEN 0.00%↑ is approaching a similar point.

Momentum on this price for ITB 0.00%↑ has been a bit less than the February move. Still, playing $73-$74 against a move towards it's own December '21 high offers a decent risk/reward.

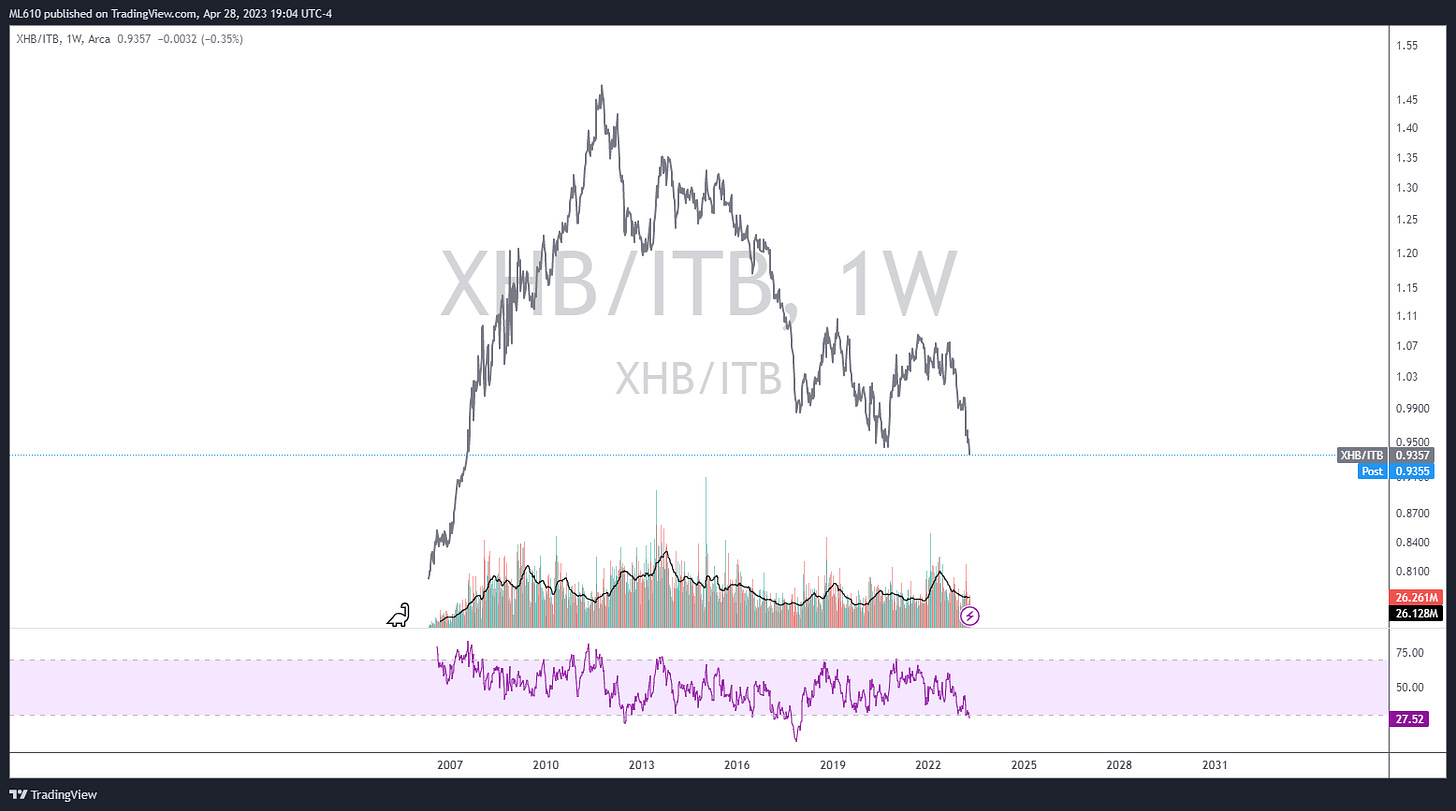

Or perhaps, the more equally weighted XHB 0.00%↑ begins to outperform, with more space towards its own prior high of December '21.

And here’s the relative comparison of XHB 0.00%↑ vs ITB 0.00%↑

ITB 0.00%↑ has seen more of its larger components report earnings thus far. My hunch is that if it's going to hold these new highs relative to February, it means we're seeing continued positive reaction to the earnings releases of XHB 0.00%↑ components, which are upcoming. In that scenario, I'd expect XHB 0.00%↑ to outperform over the short term. And if the reports are not well received, it likely means that the December '21 highs will remain just that.