Homebuilders

Wrote about homebuilders at the end of April -

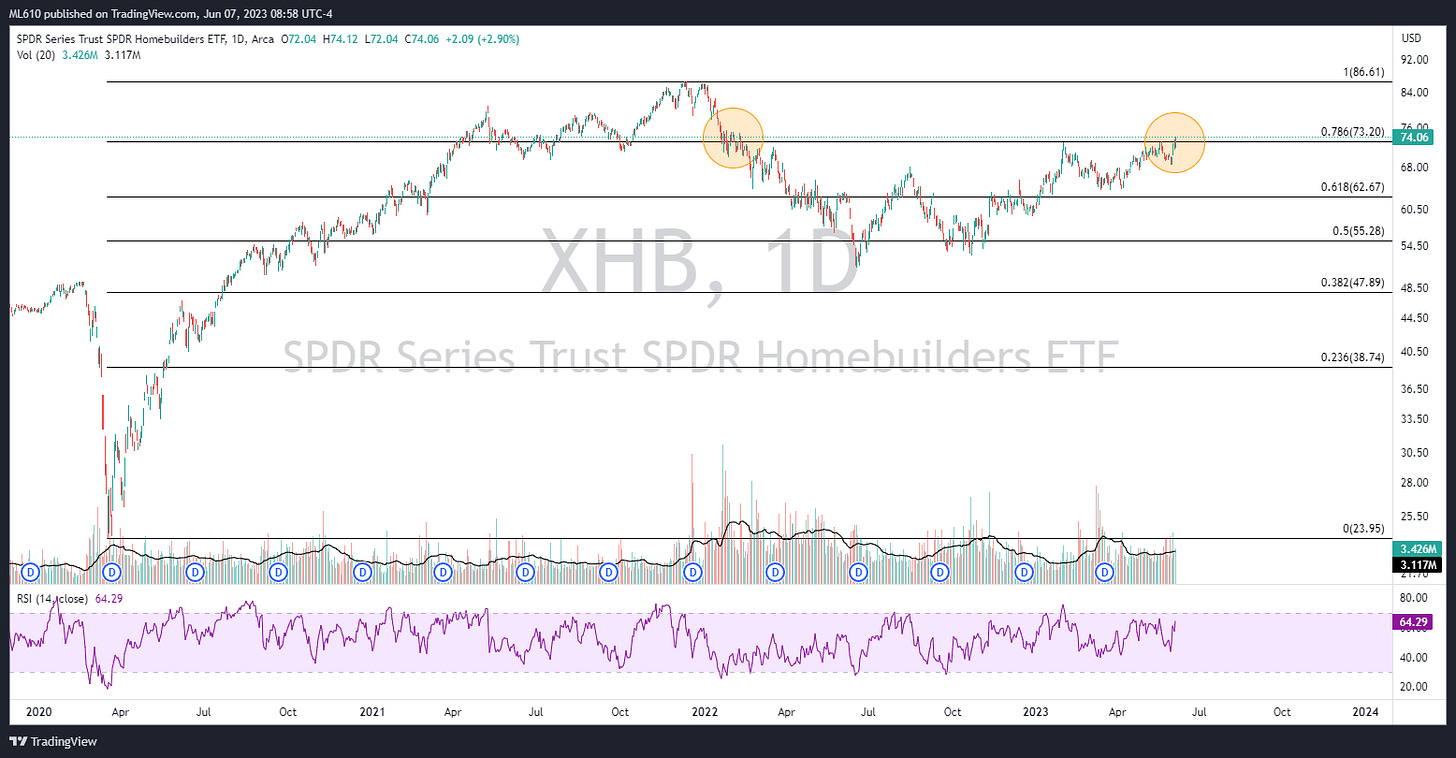

Both the XHB 0.00%↑ and ITB 0.00%↑ look positioned to retest the previously mentioned December ‘21 highs. I still remain cautious given the rate environment (7% 30 year, I’ve read about the lack of supply this has caused, which in turn has been explained as the rationale for the homebuilders catching a bid), but price is price. Interestingly, I kind of feel the same way about this setup as I did with AAPL 0.00%↑, where it ran into a prior high and, perhaps, might now be stalling out. Generals lead the way….