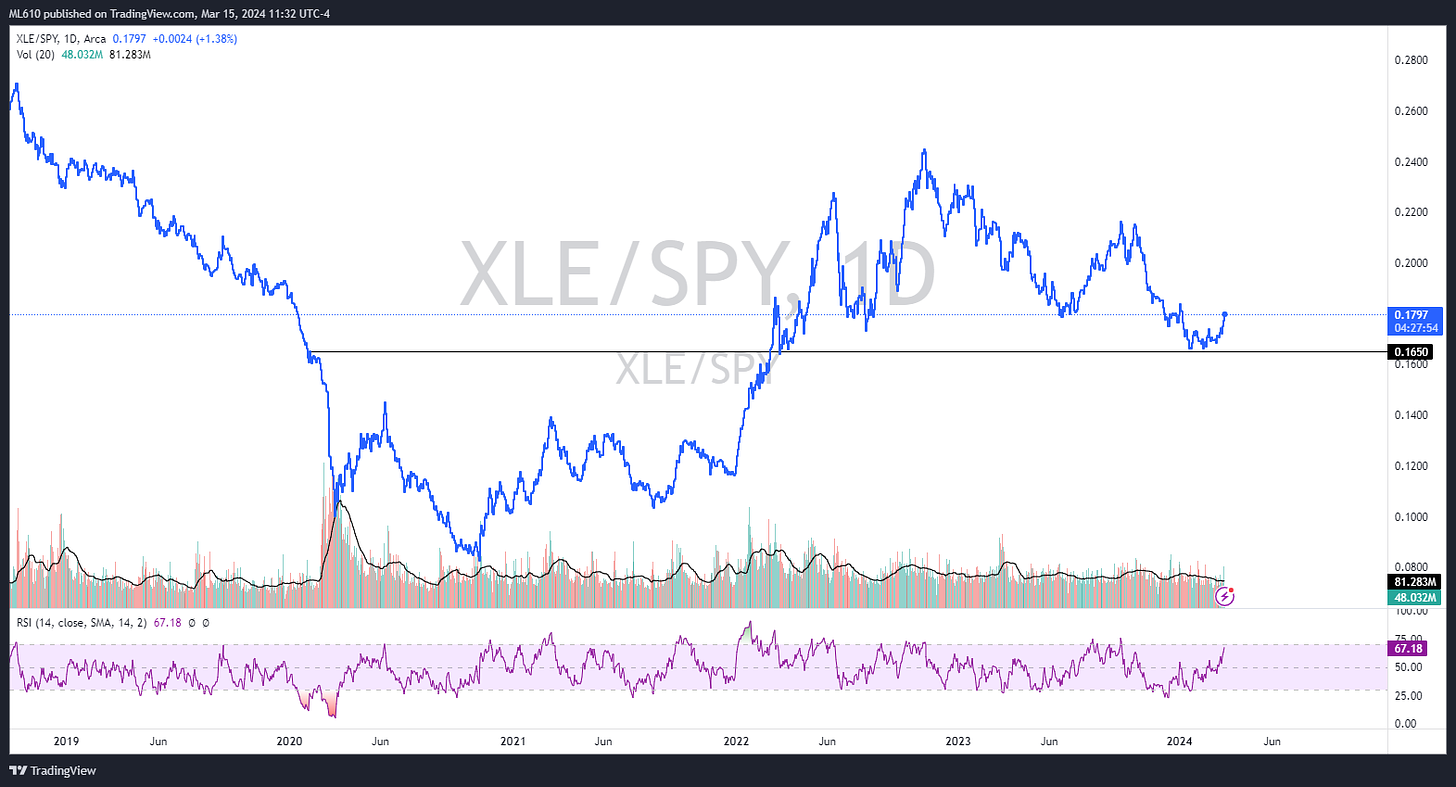

XLE 0.00%↑ has been working really well for about a month, and a relative chart (below) shows the bounce we’re getting versus the SPY 0.00%↑.

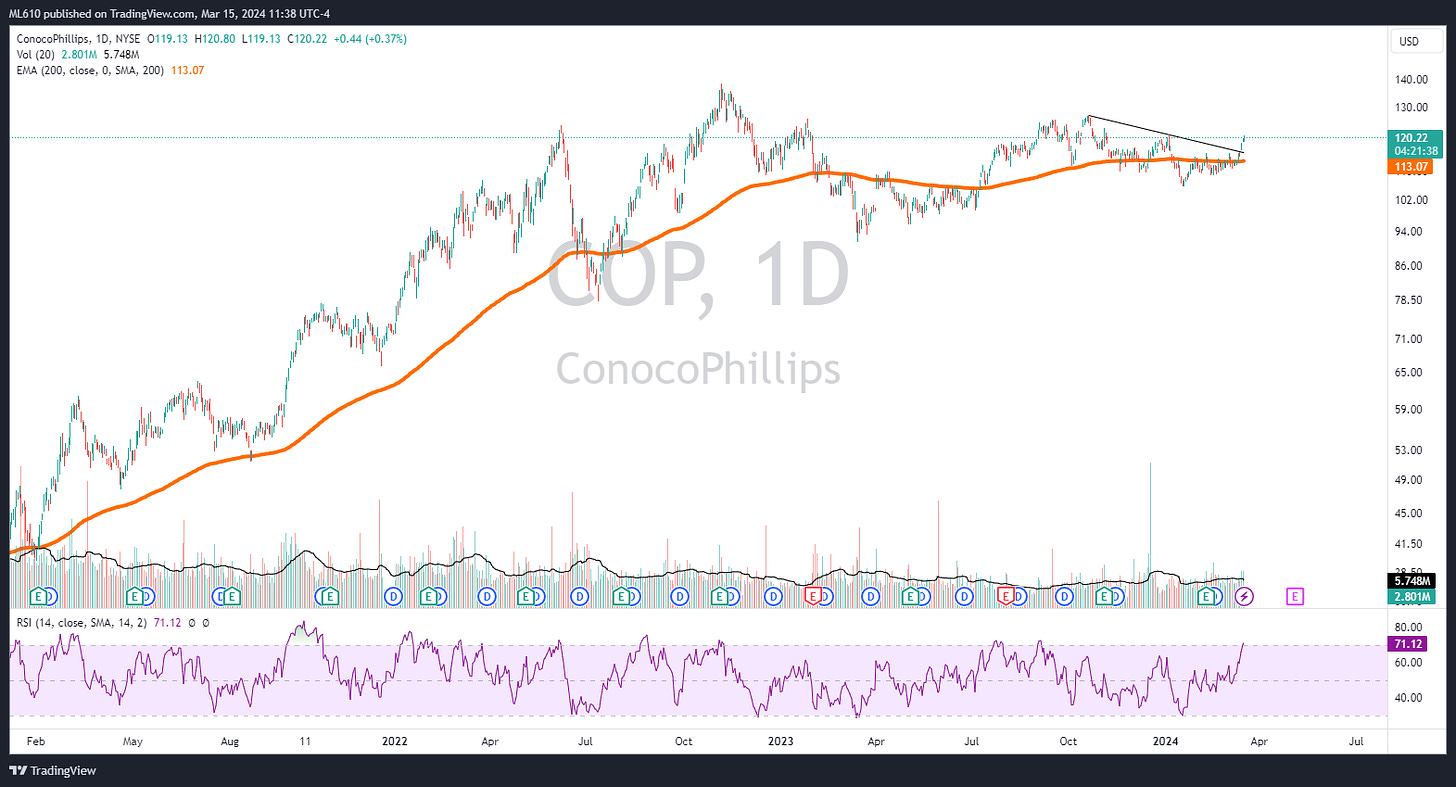

The largest components of the index are XOM 0.00%↑ and CVX 0.00%↑ . I’m not in on XOM 0.00%↑ until I can see it conquer $120.

CVX 0.00%↑ - These are low risk setups in my opinion, with earnings in the rearview and a nearby 200 day that offers a logical stop-loss point if things don’t materialize.

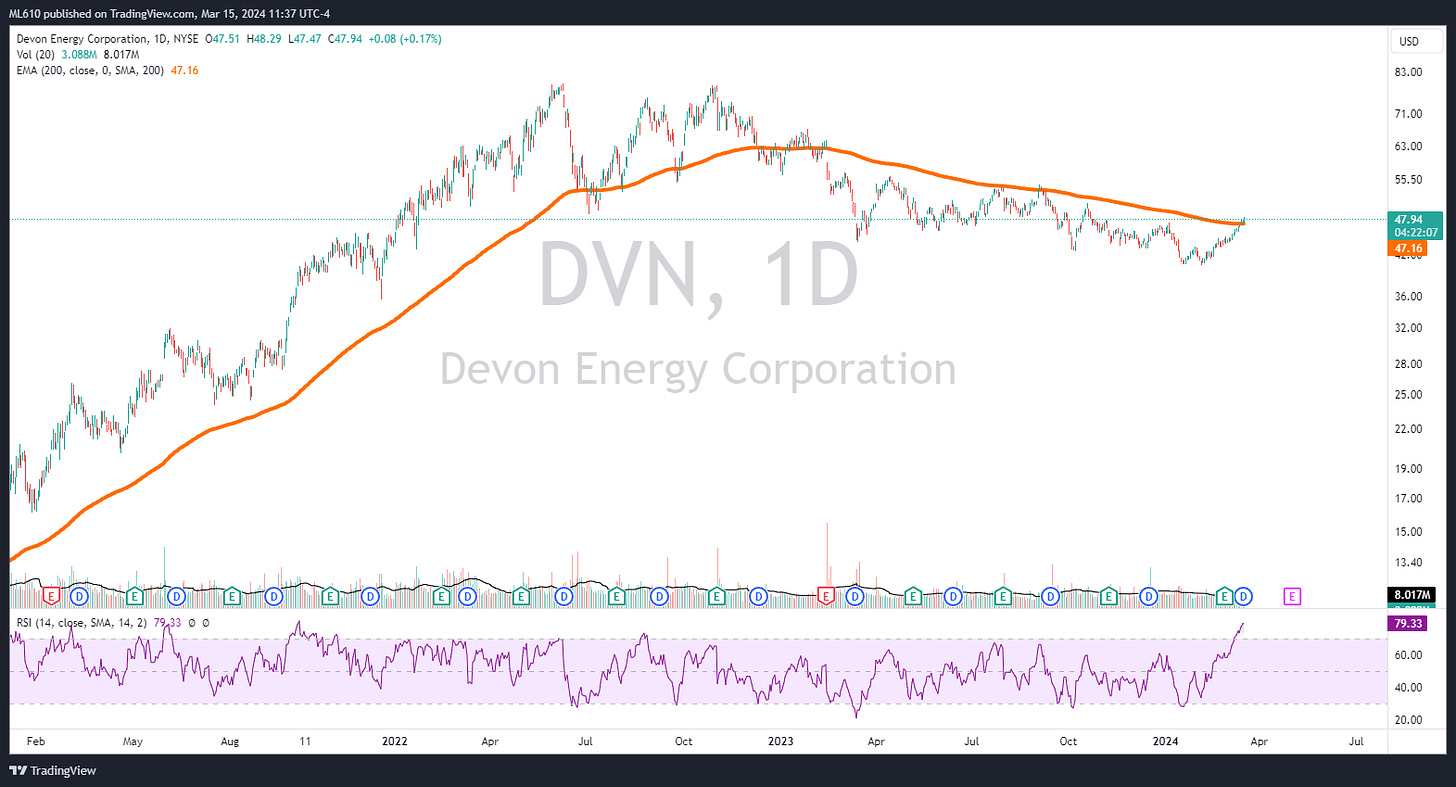

DVN 0.00%↑ - similar setup

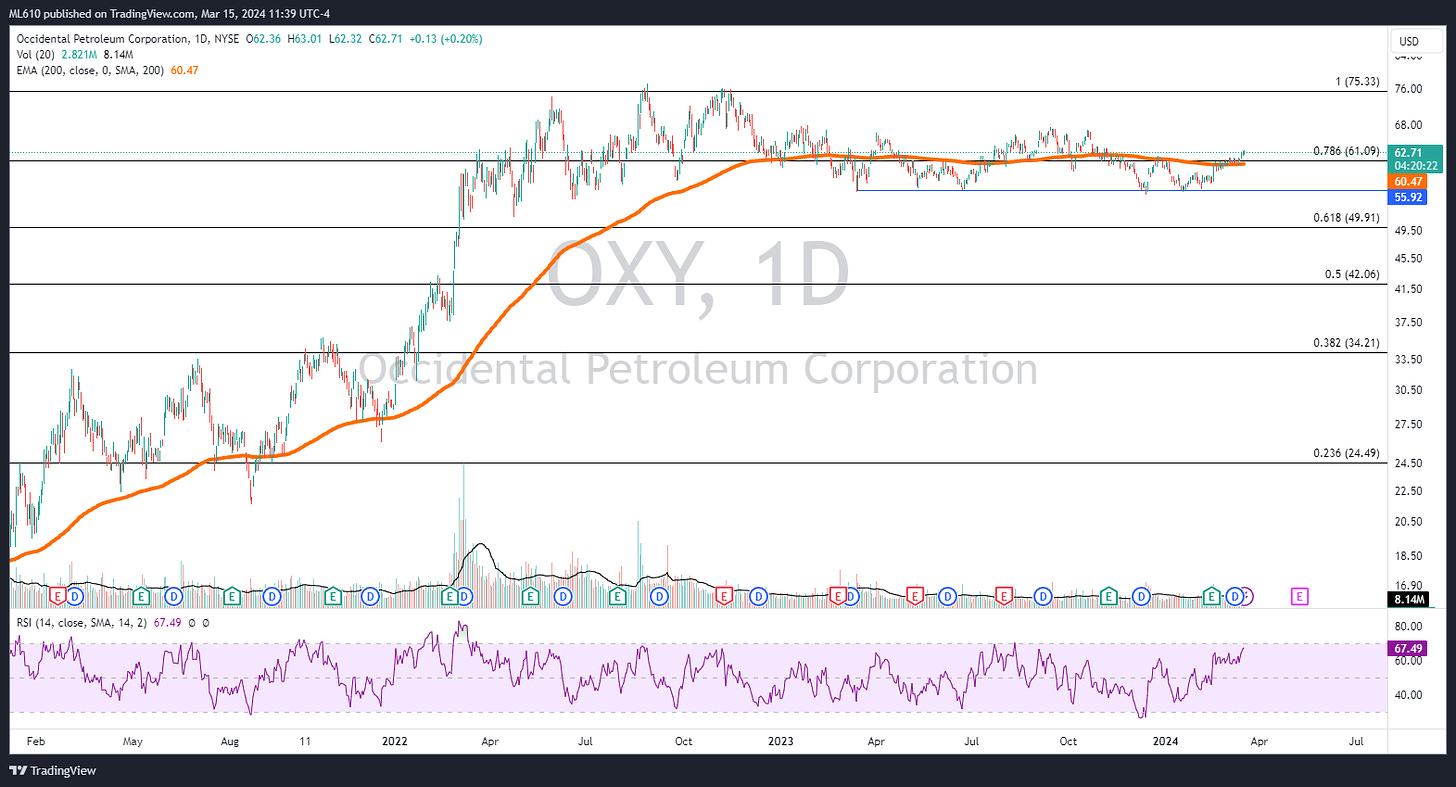

OXY 0.00%↑ - A Buffet name, they’ve made numerous buys in the $50 range.