Wrote about the XOM 0.00%↑ PXD 0.00%↑ deal a few weeks ago (https://732charts.substack.com/p/a-follow-up-on-energy) in the context of its impact on the price movement in the XLE 0.00%↑ , given its relative weighting.

Well this morning, CVX 0.00%↑ and HES 0.00%↑ announced a similar deal, and the XLE 0.00%↑ is once again selling off.

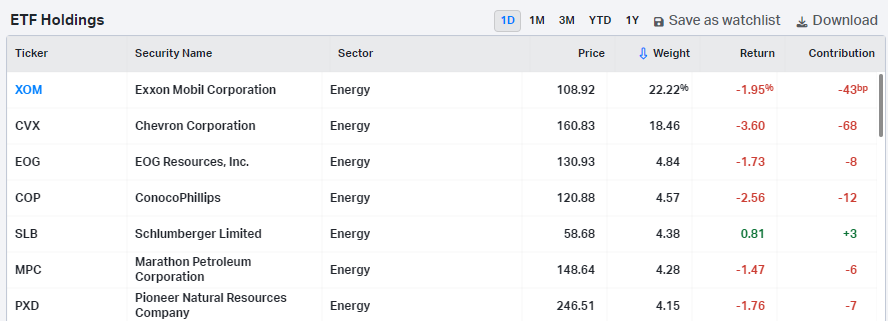

We can see the importance of both acquirors to the ETF -

The fundamental rhetoric is that these mergers signify a more positive outlook for energy over the intermediate term. That seems like a rational take, and if that were indeed to manifest, we should probably expect the XLE 0.00%↑ to takeout that high from nearly a decade ago. Over a shorter timeframe, it’s going to require a break and hold of $95. But there could be something here…