I’m a sucker for the airlines. I like to trade them. “Trade” being the operative word.

They’ve been sold off a ton, and while the trend is our friend, history shows us that there can be money made in between.

Here’s DAL 0.00%↑ - 5/20 stretched wide to the downside, with RSI levels oversold. Earnings are now in the rearview mirror.

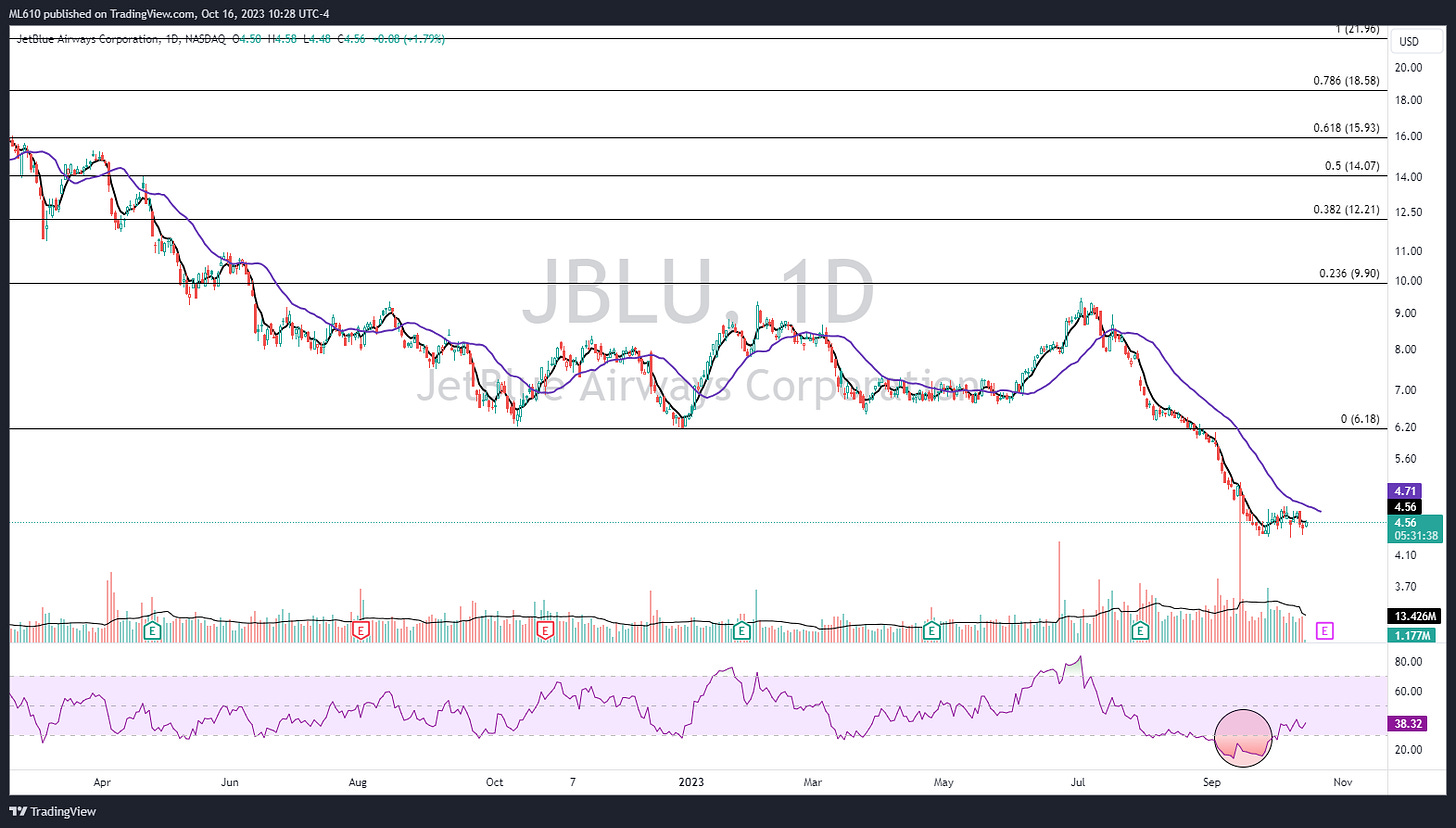

JBLU 0.00%↑ - I wouldn’t step in front of earnings on anything more than a day trade, but RSI divergence here amidst a complete sell off since the summer (Earnings 10/24)

Same story with HA 0.00%↑ (earnings 10/24 as well)

Here’s an ugly one. ALK 0.00%↑ reports this Thursday.

AAL 0.00%↑ reports Thursday as well. The black line represents the 5day MA, and the purple the 20 day MA on all of these.

Finally, UAL 0.00%↑ , which reports tomorrow.

Trading airlines isn’t for everyone. The time to generate alpha in them is usually when they’re at peak hatred, signified in oversold RSI’s. History shows us the bounces can be lucrative.