A Fundamentally Driven Short - $DASH

$DASH

Fundamentals drive technicals. While I believe you can “trade” purely on technicals, combining both offers the best opportunity for delivering alpha.

Enter DASH 0.00%↑.

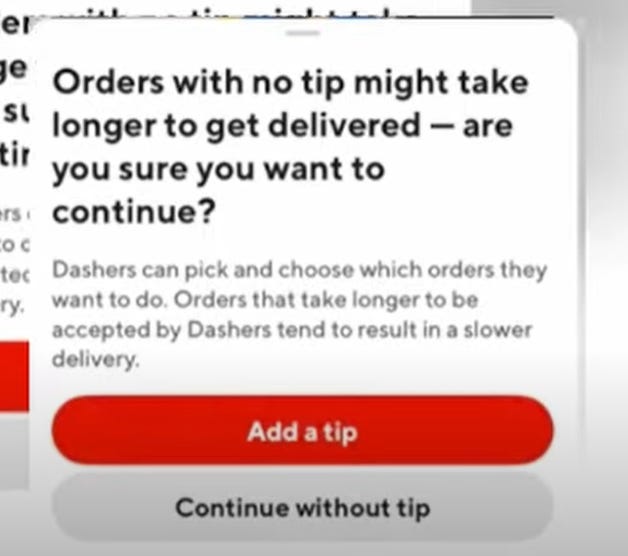

CNN published this article about a week ago (https://www.cnn.com/2023/11/01/business/doordash-tip-warning/index.html ), which highlights a phenomena that’s becoming a bigger issue for Door Dash, “tip fatigue”.

Having a background in restaurants operations in one of the biggest food delivery markets, it’s an area that’s always interested me. What I’ve gathered from listening to the drivers (something the company will never say on an earnings call) is that Door Dash has been reducing base pay, and instead shifting the onus onto the customers to subsidize their delivery cost via tips. As customers balk, the attractiveness to the drivers (who are independent contractors) becomes less. And unlike the restaurant industry, where waiters are paid a minimal min wage and rely upon tips, with food delivery you could argue that the driver has true overhead (vehicle gas and maintenance) and must be more properly compensated for such. I think this comes to a head sooner than later.

Door Dash has a market cap approximating $37 billion. Prior to falling to gig apps such as Door Dash and UBER 0.00%↑, Grub Hub achieved a peak market cap near $13 billion in 2021. And they were profitable before all of their PE backed competitors began subsidizing delivery costs with investor funds (driver pay pre Door Dash IPO was much higher than it has been since they’ve been a public company)

Door Dash will say that pivots into other “last mile” businesses will expand the growth of their business, but the reality is that those other types of deliveries are going to be even less profitable than food delivery. As of at least 3 years ago, the company was taking 20% of order value from the restaurants, an impossibility in other delivery types such as grocery or packages. They’re also competing with much more formidable behemoths, such as $WMT, $UBER, $UPS, and even CART 0.00%↑ to a degree, though I’m similarly bearish on them.

Enter the technicals

DASH 0.00%↑ popped following earnings last week, briefly making a new 52 week high before coming down some. The stock ipo’d at $182, and the AVWAP from the ipo date is around $101.50. That’s the first resistance level I’m targeting. Any short positions in the near-term would be invalidated to me on a break above that level. Shorts would become more aggressive on a pullback into that gap range, as well as a breach of the 200day.

I won’t allow my fundamental view of the business to supersede making technical driven trades. But with my inherent bias negative, I will look for opportunities that the market gives to tactically short this name.